Non-Fungible Tokens (NFT)

What are NFTs and why do they matter?

NFTs, or non-fungible tokens, are native to blockchains and, like any other token, are developed using smart contracts. ‘Non-fungible’ means they are unique, with no 1:1 relationship between one NFT and another – in contrast to something fungible like ETH or BTC. While investors are indifferent regarding which particular BTC to hold, this isn’t the case for NFTs: owning NFT #184 of a particular collection may be completely different from owning #185. Since NFTs are blockchain-native, they provide the specific origin (or ‘mint’) and all activity for the life of the asset – for example, how many holders it had, at what prices it sold, etc. – providing full transparency and accountability.

NFTs are digital assets such as digital art, music, videos, in-game characters/objects, and digital documents – but in theory they can carry a representation of any asset from the physical world. Although interest in NFTs spiked in 2021, the first was arguably created back in 2014: ‘Quantum’, minted using NameCoin, a blockchain stemming from Bitcoin's code (Link). Another early example is the Crypto Kitties game from 2017, which allowed players to buy, breed, and care for cats represented by an NFT. At its peak, Crypto Kitties was generating so many transactions it was clogging up the entire Ethereum network.

The value proposition of NFTs fits nicely with that of web3: censorship resistance, asset ownership, and self-sovereignty. NFTs provide access to asset classes previously not possible through fractionalized ownership, together with frictionless ownership transfers. Additionally, NFTs allow artists and content creators a more efficient way to monetize their work.

Primary use cases of NFTs

- Art: artists can earn direct income from the initial sale of their art. Also recurring income, via royalties, can be embedded in smart contracts so that artists also earn from the trading of their art, potentially at higher prices in the future. This category is broad, with subcategories such as music, film, graphic arts, fashion, etc. The market potential is sizeable: the music industry alone generated $16.9bn through streaming platforms in 2021 (Link).

- Games: a new trend was born in the video game industry, called Play-to-Earn games (P2E). P2E games give the player the possibility, but not the obligation, to monetize their leisure time by selling in-game items in marketplaces. For example, a player might earn a relatively rare item through playing and then decide to sell it on a marketplace for a digital currency of their choice. In addition, P2E games usually include one or more in-game currencies, which can be bought and sold on an external exchange, whether centralized or decentralized. This is radically different from traditional models such as Pay-to-Play (P2P) and Free-to-Play (F2P). Looking at those traditional models, one of the biggest P2P games is World of Warcraft (WoW), played on Windows and macOS operating systems. Released in 2004, it is estimated to have earned over $12.4bn in cumulative revenues since, mostly from subscriptions (Link). And a popular F2P game is Candy Crush, launched in 2012 – playable on Android and iOS, it has seen an estimated total revenue of $9.4bn since launch (Link). Overall, the gaming industry witnessed roughly $203bn in revenues in 2021 alone (Link).

- Collectibles: these are any items valued and sought after by collectors, for example NBA cards and soccer cards. Two notable, clear examples on web3 are NBA Top Shot (Link), valued at $2.6bn (Link), and Sorare (Link), valued at $4.3bn (Link). The definition of a collectible is somewhat vague, which fuels a debate as to whether collections of NFTs typically used as profile pictures, such as CryptoPunks and BAYC, should be classified as art or collectible? – it is the latter that has seen exponential growth in 2021.

- NFTs with utility: NFTs can also confer utility, such as receiving services or physical goods. An example is a membership pass, such as the PROOF Collective pass that grants access to a club for those dedicated to collecting and curating information from the NFT universe. Limited to only 1,000 memberships, it’s currently priced at around 90 ETH ($100,000). Another example of an NFT with utility is ticketing for physical and online concerts: by using NFTs, tickets can become usable assets, containing access credentials and unique advantages for your events. These assets can also be the subject of other transactions, allowing you to generate new revenue streams for yourself and your community.

NFT Marketplaces

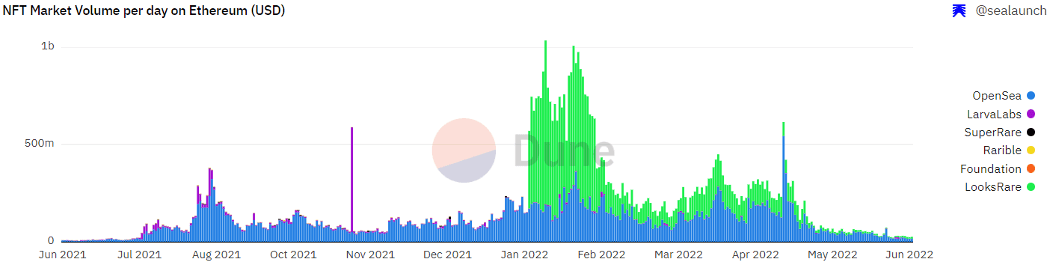

Last year’s cumulative NFT trading volume was over $66bn, transacted mostly over OpenSea and Looks Rare. OpenSea is a centralized platform valued at approximately $13bn (Link), while Looks Rare is a decentralized platform that emerged as a counterpart to OpenSea, with a current market capitalization of $340m.

Running NFT marketplaces can be highly lucrative but also competitive, with many new private companies and centralized cryptocurrency exchanges entering the field. Coinbase, one of the largest centralized exchanges, with 98m users, has launched its own NFT exchange, but with little success so far: its highest trading volume day, 1 June 2022, saw approximately $220,000 of trades, while on the same day OpenSea recorded $47m. Another company entering the sector is GameStop, launching its own NFT marketplace in partnership with ImmutableX (Link).

Looking at the bigger picture, 2021 was described by Sotheby’s as “The Strongest Total in Company’s 277 Year History” (Link), with consolidated sales exceeding $7.3bn and auctions over $6 billion. Christie's posted similar results (Link), with total sales of $7.1bn, of which $150m came from NFT sales. Analyzing market financials, December 2021 alone saw NFTs worth $3.2bn sold and January 2022, $17.1bn – although the volume declined by May, NFTs worth $4.2bn were still being sold.

Outlook

Taking a step back, similarities can be drawn with the 2017 crypto market and its bonanza of Initial Coin Offerings (ICOs), when some 800 ICOs raised $2bn in funding (Link). Like the ICO boom back then, new NFT projects without clear direction or product get created every day. Following the current NFT hype, it’s likely the large sums of money flooding into NFTs will trigger some regulatory scrutiny. Most initial sales of NFTs could come to be categorized as ‘fund raising’, since the NFT itself has no value unless, through the effort of the project promoters, this value accrues back to the NFT. Some projects can certainly be classified as a security under the SEC, based on the Howey test (Link).

On a more positive note, the participation of big brands and large companies in the metaverse, by issuing their own NFTs, is a clear signal to NFTs with strong collectible character or utility to stay. From fashion and sports companies like Adidas (Link), Prada (Link), Gucci (Link), and Nike (Link), to video game producers like Activision (Link), retailers like Shopify (Link) and banks such as JP Morgan (Link) and HSBC (Link) – all are trying to engage with the younger web3 community and explore additional ways to advertise. The NFT space is still in its infancy but has the potential to disrupt entire industries such as gaming, music, and ticketing amongst others.