An Optimistic Outlook: Ethereum Layer 2 Scaling

In our August 2022 newsletter, we talked about ways to scale Ethereum (and blockchain in general). With the discussion on scaling blockchain technology being as old as blockchain itself, this edition examines the hottest scaling technologies and their adoption at the moment called Rollups. It is an exciting time, with Arbitrum and Optimism dominating the landscape, numerous zk-rollup solutions about to launch – and a lot of competition between different Rollups, which people are calling the "L2 wars."

Recap: Rollups

Currently, the most promising Ethereum scaling solutions build on some form of rollup technology. Rollups are layer 2 solutions for Ethereum that execute transactions outside of layer 1 and batch them before sending the data back to Ethereum mainnet. This increases transaction throughput and fastens transaction confirmations. Meanwhile, security is guaranteed through validity checks, anchoring to layer 1, and providing dispute opportunities.

There are two main categories of rollups: optimistic rollups, which basically assume transactions are valid by default and allow for challenge via a fraud proof. And zero-knowledge rollups, which use off-chain computations to create cryptographic proofs for each transaction bundle. The latter is considered to be more secure but more complex and slower.

Status Quo

The lay of the land with scaling solutions is as follows. Besides sidechains like Polygon, dominating the layer 2 space are Optimism and Arbitrum, which launched their mainnet in autumn 2021. They’ve been widely adopted since, with Arbitrum even topping Ethereum’s daily transaction activity at times. Combined, the two scaling solutions have a layer 2 market share of >80%, whereas Arbitrum currently has more traction, users, and TVL.

This is despite Optimism airdropping their OP token to early users back in May 2022 and offering liquidity rewards for apps on its network. Arbitrum, on the other hand, held off launching its governance token until this month, when it announced its ARB airdrop on March 16, 2023. The token immediately listed on most major exchanges and is currently the #8 crypto asset by fully diluted market cap (#34 based on circulating market cap).

Besides these, there are numerous zk-rollup based scaling solutions, which are progressing fast towards public launch. zkSync won the race to the first EVM-compatible, zk-rollup-based, layer 2 and released their public mainnet “zkSync era” on March 24, 2023. Polygon, which is also heavily focused on its zk-efforts, followed suit two days later and released the beta mainnet for its Polygon zkEVM network.

In addition, there are additional interesting, highly backed, projects working on their zk-rollup based scaling solutions, such as Consensys, Scroll, and Aztec Network. These developments are expected to further fuel layer 2 adoption and potentially lead to new distributions in market share compared to the status quo.

Adoption

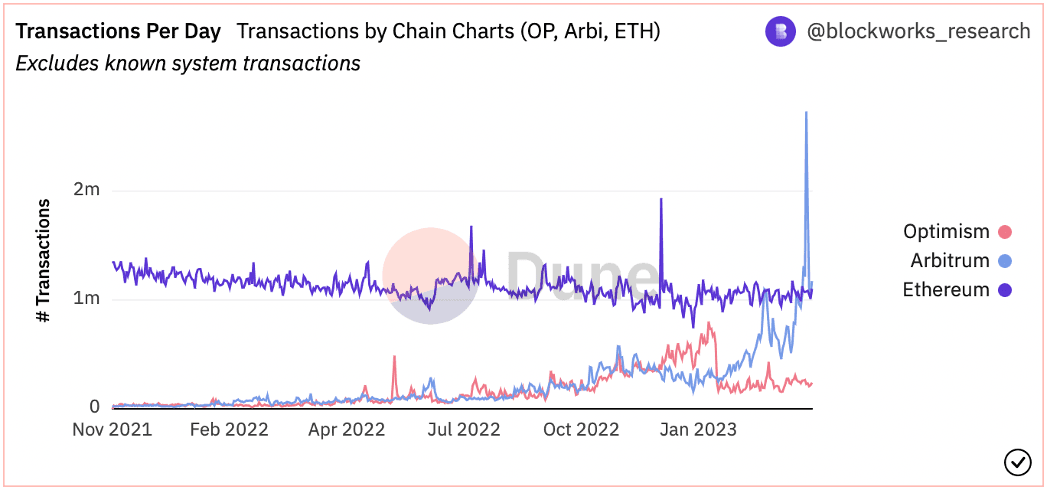

What about adoption of the predominant layer 2 scaling solutions? Figure 1 shows daily transactions on Ethereum, Arbitrum, and Optimism. There are a few interesting things to note. Firstly, transactions for Ethereum are in a downtrend. This could be because of (1) increased substitution through (cheaper) scaling solutions, or (2) simply decreasing demand correlating to the decreased prices of crypto assets.

Secondly, both scaling solutions continuously increased daily transactions over time. In terms of Optimism (red), there was an initial spike in transactions in May 2022 (approx. 0.5m daily transactions), which corresponds to its OP airdrop and related activity on the network. Transactions then rapidly increased during summer and autumn, which was in part related to liquidity incentives and an NFT-based onboarding program.

The sudden drop in early 2023 marks the end of this program. Looking at Arbitrum (light blue), there is a more continuous increase in transactions, which significantly outperformed Optimism so far in 2023. On February 21, Arbitrum recorded a record 1.1m transactions, making it the first time a layer 2 processed more transactions than Ethereum’s mainnet. This record was then broken by a huge margin on March 23, the day people were able to claim their ARB airdrop. That day, Arbitrum processed 3.1m transactions (an average of 35.8 transactions per second).

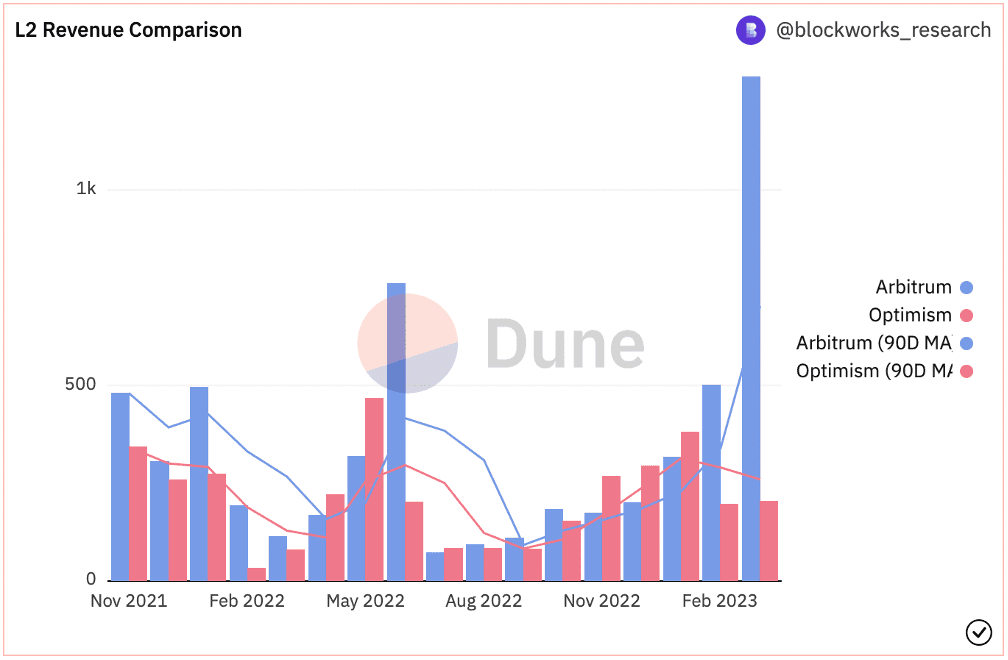

Figure 2 provides valuable insight into actual revenues collected at protocol level. Keep in mind, these numbers are in ETH and calculated as net revenues, i.e., as the difference between gas fees on the respective layer 2 network and the gas cost of posting respective calldata to Ethereum mainnet. Therefore, assuming an ETH price of $1’800, March revenues for Arbitrum come in at $2.3m, and for Optimism at $365k.

Looking at Ethereum mainnet revenues generated, the two combined fees paid by users (i.e., burnt) a total 9’340 ETH since the Ethereum merge took place in September. To put it into context, this corresponds to approx. 2.3% of total ETH burnt during that period. The top burning actions since the merge have been ETH transfers on mainnet (25’200 ETH burnt), OpenSea (23’400 ETH burnt), and Uniswap (20’700 ETH burnt).

Both Optimism and Arbitrum are actively working to expand the ecosystem – with somewhat different approaches – using their codebase beyond the main chain. Optimism on one hand allows for free usage of the OP-stack for other developers to deploy additional layer 2 networks, settling on Ethereum mainnet. This resulted in a recent partnership with Coinbase, which announced it will be launching their own layer 2 called “Base”. In turn, they are providing significant development resources to the shared codebase and will pay a part of the transaction fees to Optimism. Arbitrum on the other hand restricts the usage of their codebase for other developers and puts it to the DAO to vote. However, they do provide resources to set-up layer 3 chains which settle on Arbitrum’s layer 2.

Summary / Outlook

Ethereum layer 2 scaling has been a top priority on the Ethereum roadmap, with Vitalik Buterin himself drawing attention to its importance multiple times. The adoption of the first solutions based on optimistic rollups has been stellar and has significantly increased the number of transactions Ethereum can handle.

Nonetheless, this is only the beginning and there are many directions that increased scalability could go.For example:

- Increasing transaction throughput of existing scaling solutions through technological updates

- Parallel deployment of additional layer 2 projects, as well as projects re-deploying existing codebases (e.g., Base)

- App-specific rollups and layer 3 scaling, settling on layer 2

- And an exponential effect through sharding on layer 1 (i.e., enabling parallel execution across a number of layer 1 Ethereum chains).

As things stand, costs to transact with the safety guarantees of Ethereum have decreased by a magnitude with instant transfers costing a few cents and smart contract interactions mostly below $1 (on layer 2). With many promising projects in their final stages before mainnet launch, we’ll be watching this space closely for continued innovation as the L2 wars play out.